There are a myriad of factors that affect the price of fuel, and we break them down for you here.

The cost of fuel is a favourite topic in boardrooms and around the braai. We all complain and speculate but, let’s be honest, few people can give a detailed breakdown of precisely how the price of fuel is determined. If you want to sound clever at your next meet-up, read on.

The starting point for fuel pricing is the cost of Brent Crude Oil (the basic ingredient in petrol). The cost of Brent Crude is determined by the age-old cornerstone of commerce: Supply and Demand.

Where the Brent Crude is purchased makes a difference. South Africa generally buys from refineries based in Singapore and Bahrain. The purchase price will differ slightly between the two all depending on the costs incurred by the refineries in purchasing and transporting the Brent Crude and refining it into Petroleum.

The price South Africa then pays for the refined petroleum depends on the current exchange rate between the US Dollar and the South African Rand, as Brent Crude is always quoted in US Dollars. This is known as the Basic Fuel Price (BFP). Although the exchange rate continually fluctuates and changes daily, SA’s Department of Energy (DOE) only alters our BFP on a monthly basis. Every month the DOE assesses the fluctuations in the exchange rate and adjusts the BFP accordingly, making up for under or over-pricing throughout the month.

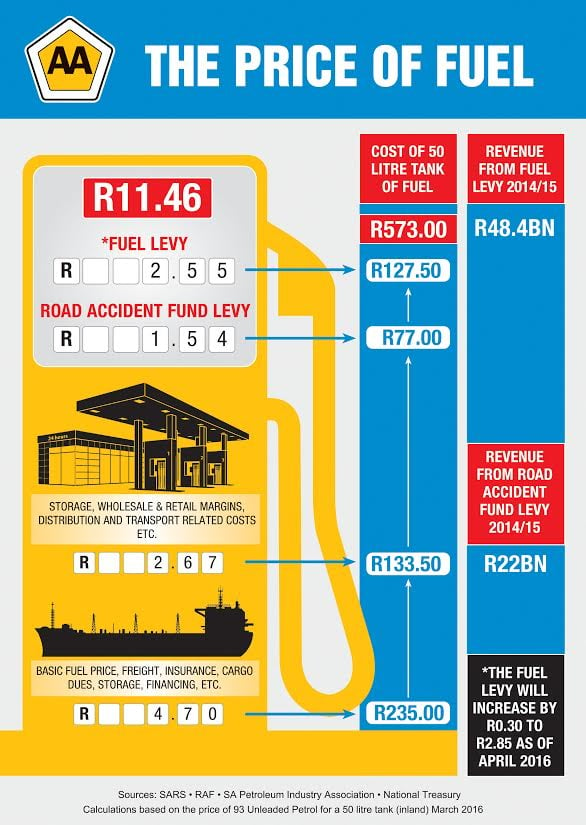

Once the fuel has been purchased, additional costs such as transporting the fuel to SA, customs duties, insurance, harbour costs, and storage facilities come into play. These costs also fluctuate depending on which storage facilities are used and how long the Brent Crude is stored.

Local transport and storage costs further influence the price of fuel. That’s why fuel is always more expensive inland than at the coast – because it needs to be transported further.

In addition to all the above factors, South Africa adds a Fuel Levy, which is a tax amount collected on every litre of fuel sold. This tax is administered by the National Treasury and used for a variety of purposes.

Here’s an excellent infographic by the AA that demonstrates these principles in action:

In other words, it’s complicated! The price we pay when filling up our vehicles is the result of global exchange rates, transport distances, customs and storage costs as well as a national levy. If you break it up into the above steps, however, it’s much easier to see why the price of fuel is in a constant state of flux.